In the hotel industry, contactless payment options are becoming more and more common, and for good reason. They utilise some of the newest technology while giving your visitors a more streamlined experience. It is crucial to examine this idea in further detail.

What is a Contactless Payment?

As the name implies, this kind of transaction enables customers to avoid utilising cash or actual credit cards in tangible form. Instead, it makes use of wireless techniques like RFID technology. This method is supported by debit cards, credit cards, and even certain smartphones. Users need only bring their card or other item up against a near-point terminal. After that, the transaction can be finished.

Also of interest to you is the fact that no PIN is necessary for the processing of a payment. For individuals who are on the run or may be in a public setting, this is quite practical. Payments made with contactless technology are capped at a particular amount at any given moment to provide the highest levels of security. The good news is that this technology has now made its way into the hotel sector and can directly affect your guests’ experiences.

How Do Contactless Payments Work Within the Hospitality Sector?

The good news is that contactless payments may be made in a simple and uncomplicated manner. A 90-degree-flipped WiFi logo will be visible on devices that support this technology. Consider for a moment that a visitor wants to reserve a space at your establishment. When instructed, the user will first place the card or device within two inches of the processing equipment. The guest will be informed by a green light, a buzzer, or some other similar method if the system recognises the card and authorises the transaction.

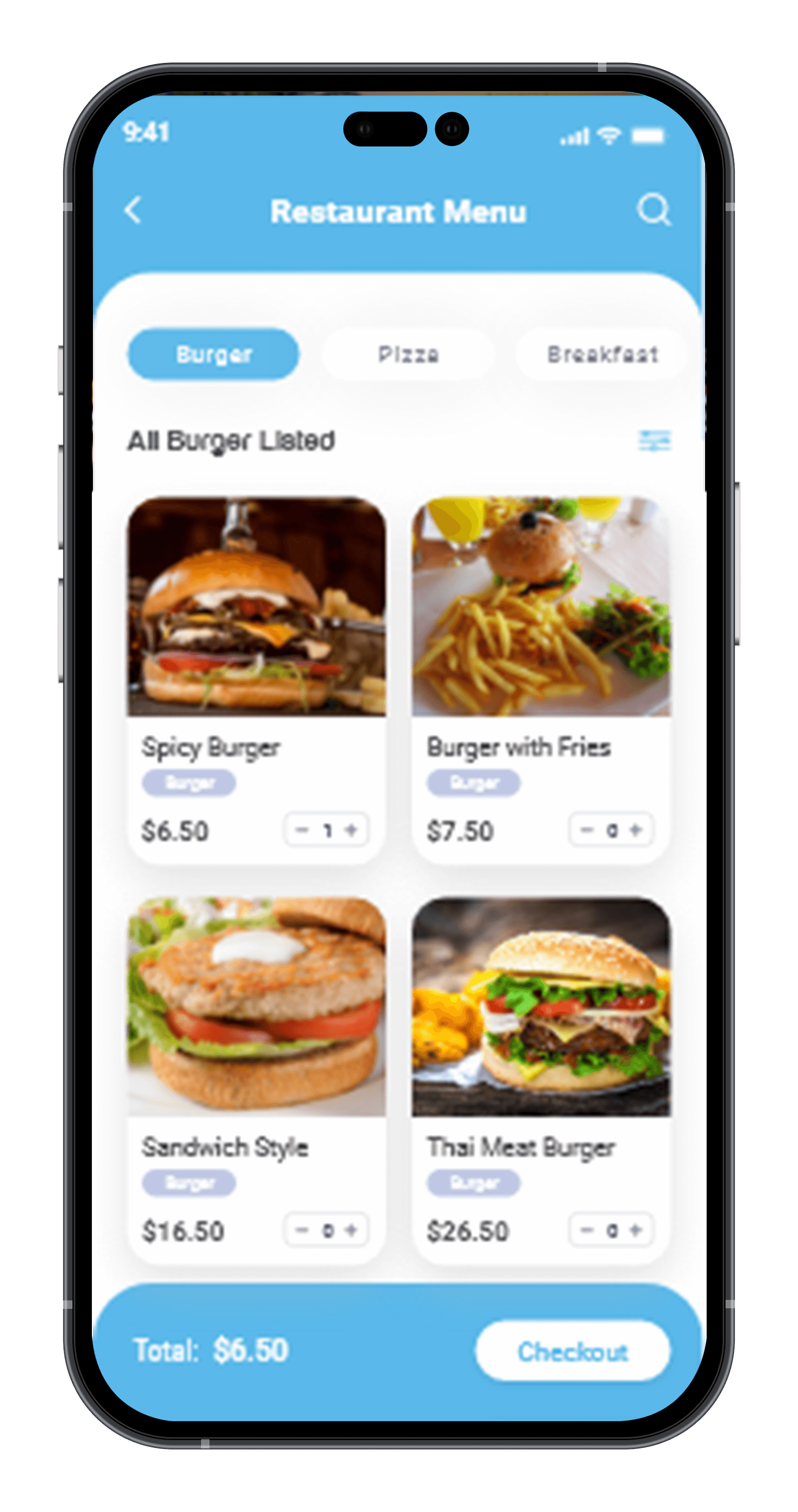

As previously noted, credit and debit cards can also be linked to smartphones by downloading a specific application made available by the relevant institution. Then, with only a tap of the screen, they may complete a transaction (like making a hotel reservation). This contactless payment mechanism is expected to grow in popularity over the next few years as some smart watch models start to accept it.

3 Reasons Why Contactless Payments are getting Popular in the Hospitality Industry

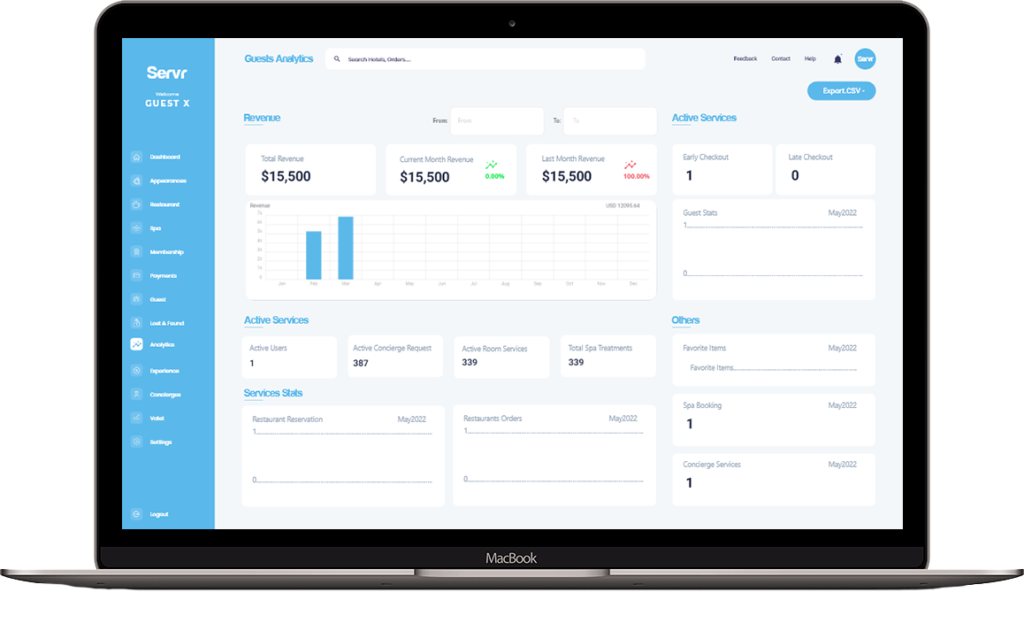

The observations made above show that one of the most noticeable changes in hospitality was contactless payment methods. Managers should therefore think about its implementation in order to stay one step ahead of the competition. Let’s now look at some of the most notable benefits that your property might anticipate gaining through the use of this cutting-edge technology.

-

A Viable Hygienic Solution

As you undoubtedly know, the recent coronavirus outbreak has significantly impacted the hospitality sector. The phrase “business as usual” needs to be slightly reinterpreted in light of this. More than ever, visitors will be worried about cleanliness. Future years are likely to see this pattern persist. Therefore, the most popular payment methods are likely to be those that do not involve physical contact. Hotels that are able to provide these services will unquestionably outperform their rivals.

-

Fast and Secure

According to experts, contactless transactions often take only 15 seconds to complete. This happens almost twice as quickly as using a debit or credit card. Naturally, individuals who are stressed for time or have just finished the last part of a long journey will find this quickness convenient.

The fact that this system uses a variety of special encryption techniques makes these payment methods advantageous for the hotel industry. Personal information cannot be disclosed to a third party in the event that a card (or phone) is lost. This also holds true for duplicate transactions that may be fraudulent. Such details would surely give your visitors extra peace of mind while they are staying. Advanced wireless encryption is used in contactless payments, virtually eliminating the possibility of data loss or corruption.

-

Superior Levels of Customer Satisfaction

It goes without saying that if you want to experience improved booking and retention rates, the end-user experience is essential. Users can complete transactions with contactless payments in a considerably shorter amount of time. It’s also crucial to note that many people will actually spend more if the transaction procedure is made simpler. Therefore, these techniques can occasionally be used to provide upgrades and other in-room amenities that the guest might otherwise overlook. This takes us to our last—and possibly most important—point.